car lease tax benefit

Note that while the excise tax on vehicle sales is processed through DC DMV the use tax for leases is processed through the DC Office of Tax and Revenue. Unlike in USA and elsewhere car lease in India is actually a hire-purchase scheme.

Is Your Car Lease A Tax Write Off A Guide For Freelancers

The most common method is to tax monthly lease payments at the local sales tax rate.

. P11D value of the car x CO2 Benefit-in-kind tax rate x. Check out whos eligible and how to claim. This is a massive incentive to switch and the tax relief may not be around forever.

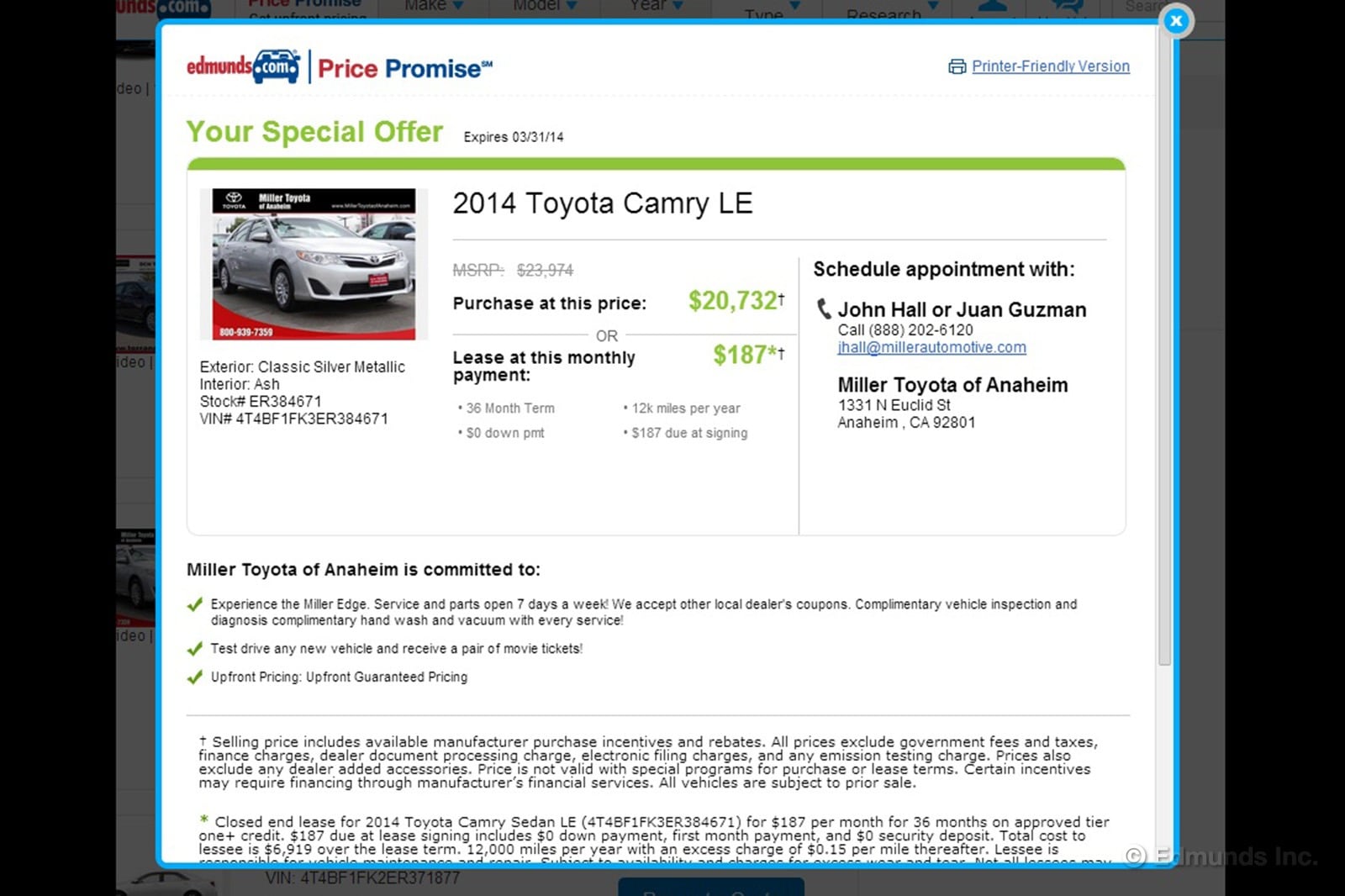

The buy option at the end of lease is also available abroad but it is an option. As a result leasing was almost always a more attractive option for more expensive cars. Leasing a vehicle could help you save as much as 30 on your taxes.

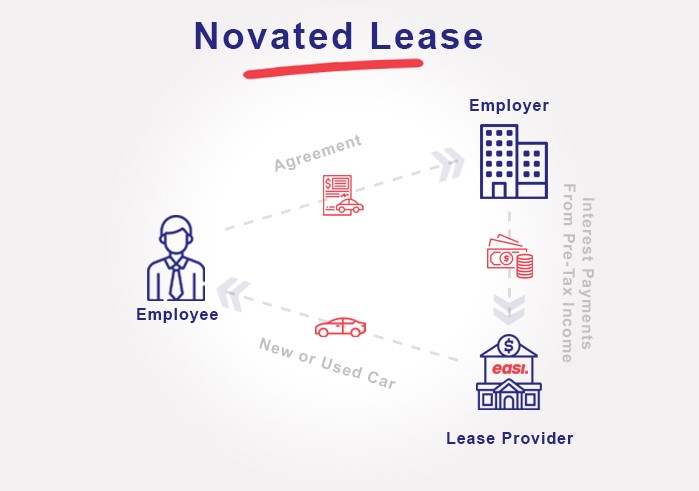

There are two issues here if you purchase a car in the name of the business and you use the car for work and business purposes then the use of the car will be deemed to be a. When you lease though youre doing so with pre-tax dollars. Because your business needs that greater pre-tax income to net the 60000 needed to make the purchase.

The three-tenths of one percent 003 Motor Vehicle SalesLease Tax that was implemented July 1 2003 still applies to the sale lease or rental of motor vehicles. As well as the Plug in Car Grant of 3000 for cars costing up to 50000 and the 350 grant towards home. Tax benefits on the car lease facility provided by the employer can be claimed depending on the ownership of the car and expenses incurred.

In India there is no. Various components are then added to this number to create your final salary package. The lease terms are.

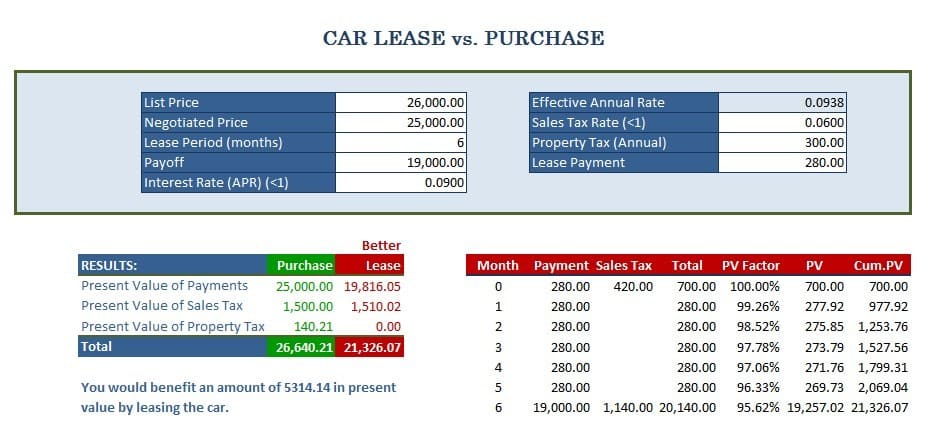

In 2017 the depreciation limit on a used car was 3600. The PARF rebate of the car when it is de-registered between 9 and 10 years old is 24000. Tax Tricks and Loopholes Only the Rich Know GOBankingRates When comparing the same vehicle as a lease versus a purchase the monthly payments and the initial down.

The lease amount you pay for a vehicle is eligible for tax relief. Answer 1 of 3. When an employer talks about your salary they mean your basic starting salary.

You can claim back up to 50 of the tax on the monthly payments of your lease up to 100 of the tax on a. Car park and ERP charges 1550. If you use your leased vehicle for business purposes you can generally directly deduct the costs as business expenses monthly payments insurance mileage maintenance.

Actual amount incurred by the employer. Car maintenance and repairs 1200. This means you only pay tax on the part of the car you lease not the entire value of the.

Car lease payments arent always tax deductible but with business leasing you can reclaim up to 100 of VAT. To calculate exactly how much company car leasing tax youll have to pay each year you use the following formula. The lease payments are calculated so that over the three-year term they equal 40000 minus the residual value at the.

The computation of tax implications will be as follows. This is applicable for self-employed as well. Therefore business leasing can be seen as very tax efficient.

Deduct a amount of Rs 2400 from the above figure for a car above 16 litres OR a amount of. As previously mentioned business leasing can provide considerable tax benefits. FMC as lessor pay the dealer the 40000 balance.

However taking all of these. How much you can offset against the monthly rental depends on the CO 2 emissions of the car or cars you are leasing.

Company Cash Allowance Vs Company Car Vanarama

How Does Leasing A Car Work Earnest

What Is The Car Lease Program In Accenture How Does It Work Quora

/is-a-high-mileage-lease-right-for-me-527161_FINAL-a6fc1fa14dd246cd93c63cf8d96bd931.png)

Is A High Mileage Lease Right For Me

10 Steps To Leasing A New Car Edmunds

5 Benefits Of Leasing Electric Vehicles Car Lease Electric Car Lease Hybrid Car

Novated Lease Vs Car Loan What S Cheaper Easifleet

Is It Better To Buy Or Lease A Car Taxact Blog

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

New Business Vehicle Tax Deduction Buy Vs Lease Windes

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

The Tax Advantages Of Car Leasing Complete Leasing

Tax Implications Of Business Car Leasing Company Car Lease Tax

Is It Better To Buy Or Lease A Car Taxact Blog